WHAT IS RBI’S FINANCIAL INCLUSION INDEX?

Financial Inclusion Index

On August 17, 2021, the Reserve Bank of India (RBI) launched a Financial Inclusion Index (FI-Index) to track the process of ensuring access to financial services, timely and adequate credit for vulnerable groups such as weaker sections and low-income groups at an affordable cost.

The Fi-Index is a comprehensive index, incorporating details of banking, investment, insurance, postal, as well as the pension sector in consultation with government and respective sector regulators.

Read More..

LATEST UPDATES ON RBI’S FINANCIAL INCLUSION INDEX

-

Financial inclusion major step towards inclusive growth: FM Sitharaman

Financial inclusion major step towards inclusive growth: FM Sitharaman

Financial inclusion is a major step towards inclusive growth which ensures the overall economic development of the marginalised ...| August 28, 2022, Sunday -

RBI's March financial inclusion index shows growth in all segments

RBI's March financial inclusion index shows growth in all segments

The index has risen to 56.4 in March 2022, against 53.9 as of March 2021| August 02, 2022, Tuesday -

RBI's financial inclusion index rises; showing growth across all segments

RBI's financial inclusion index rises; showing growth across all segments

The RBI's composite financial inclusion index (FI-Index) capturing the extent of financial inclusion across the country rose to ...| August 02, 2022, Tuesday -

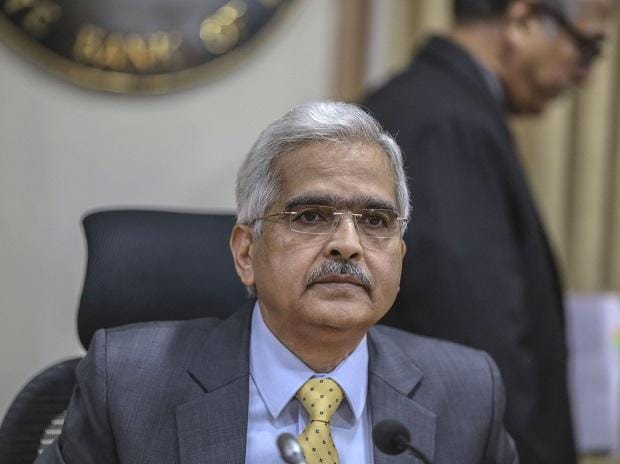

RBI Governor Shaktikanta Das says will bring financial inclusion index soon

RBI Governor Shaktikanta Das says will bring financial inclusion index soon

Financial inclusion will continue to be the policy priority for the central bank, to make the post-pandemic recovery more ...| July 15, 2021, Thursday -

Govt announces states' financial inclusion index, easy online MSME loans

Govt announces states' financial inclusion index, easy online MSME loans

Jaitley said the financial inclusion index would create an element of competition among states with each of them vying for ...| September 25, 2018, Tuesday