WHAT IS BANK RATE?

Bank Rate

The minimum rate of interest, which a central bank charges (in India's case - Reserve Bank of India), while lending loans to domestic banks is called "Bank Rate". When a bank suffers fund deficiency, it can borrow money from RBI to continue services.

When Bank Rate is increased by the central bank, a commercial bank’s borrowing costs hikes, which reduce the supply of money in the market.

Read More..

LATEST UPDATES ON BANK RATE

-

Bank of Maharashtra bucks the trend, cuts MCLR by 20-35 basis points

Bank of Maharashtra bucks the trend, cuts MCLR by 20-35 basis points

The state-owned lender cut overnight and one-month MCLR by 25 bps to 6.90 per cent and 7 per cent| July 11, 2022, Monday -

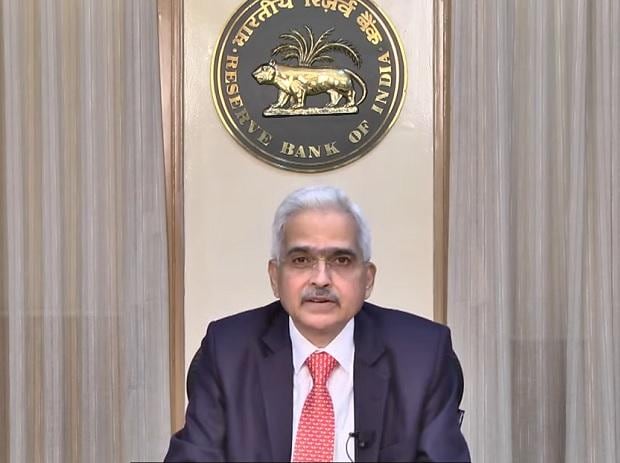

RBI policy highlights: Prioritising inflation over growth, says Das

RBI policy highlights: Prioritising inflation over growth, says Das

RBI Monetary policy LIVE updates: As expected by market participants, RBI retained status quo on key interest rates. Governor ...| April 08, 2022, Friday -

Parliament LIVE: UPA term was India's 'andhkaal', says FM Sitharaman

Parliament LIVE: UPA term was India's 'andhkaal', says FM Sitharaman

Rampant corruption, double digit inflation, policy paralysis were part of the dark age under Congress rule, says Sitharaman| February 10, 2022, Thursday -

RBI Monetary policy highlights: Lending rates unchanged amid Omicron scare

RBI Monetary policy highlights: Lending rates unchanged amid Omicron scare

RBI Monetary policy LIVE updates: RBI announcement comes amid the threat surrounding Omicron coronavirus variant. Stay tuned for ...| December 08, 2021, Wednesday -

Monetary policy highlights: Growth not at pre-pandemic level yet, says RBI

Monetary policy highlights: Growth not at pre-pandemic level yet, says RBI

RBI Monetary policy highlights: RBI announcement comes against the backdrop of Covid-19 infections receding in recent days and ...| October 08, 2021, Friday -

RBI MPC highlights: 2nd wave has moderated; expect demand to pick up

RBI MPC highlights: 2nd wave has moderated; expect demand to pick up

RBI Monetary policy highlights: Governor Shaktikanta Das announced decisions on key rates after the MPC concluded its three-day ...| June 04, 2021, Friday -

RBI Monetary policy highlights: Inflation outlook uncertain, says RBI guv

RBI Monetary policy highlights: Inflation outlook uncertain, says RBI guv

RBI Monetary policy: RBI today decided to keep rates unchanged today amid rising inflation, lockdowns and Covid surge. Stay tuned ...| April 07, 2021, Wednesday -

RBI's monetary and Centre's fiscal policy are moving hand-in-glove

RBI's monetary and Centre's fiscal policy are moving hand-in-glove

RBI has done exceptionally well in managing government's extended borrowing this year when fiscal deficit has shot-up to 9.5 per ...| February 05, 2021, Friday -

RBI MPC highlights: Rates, stance unchanged, CRR to be restored, and more

RBI MPC highlights: Rates, stance unchanged, CRR to be restored, and more

Projection for CPI-based inflation revised to 5.2% for Q4 of FY21, for H1 of FY22 at 5% to 5.2%, and for Q3 of FY22 at 4.3%| February 05, 2021, Friday -

LIVE: RBI says will undo damage inflicted on economy by Covid-19 in FY21-22

LIVE: RBI says will undo damage inflicted on economy by Covid-19 in FY21-22

RBI Monetary policy LIVE updates: MPC voted unanimously to keep rates unchanged, said RBI governor Shaktikanta Das. Stay tuned ...| February 05, 2021, Friday