-

ALSO READ

Sensex jumps 379 pts, Nifty tops 17,800; auto stocks in fast lane, PSBs dip

TMS Ep116: Russia-Ukraine crisis, NSE, markets, red herring prospectus

Who is the mysterious yogi in the NSE saga?

CBI questions ex-NSE GOO over abuse of co-location facility by broker

Stocks to Watch: ITC, Zomato, Eicher Motors, Hero Moto, Voltas, Telcos

-

Benchmark BSE Sensex rose by over 379 points while Nifty closed above the 17,800 level following gains in oil & gas, banking and auto shares on easing inflation concerns.

The 30-share BSE benchmark index advanced 379.43 points or 0.64 per cent to settle at 59,842.21, logging its third straight day of gains. During the day, it jumped 460.25 points, or 0.77 per cent to 59,923.03.

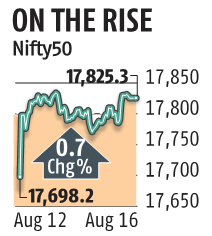

Extending its gaining streak to a sixth session in a row, the broader NSE Nifty climbed 127.10 points, or 0.72 per cent to close at 17,825.25 as 42 of its constituents advanced.

Easing inflation concerns after the wholesale price-based inflation slowed down to a five-month low of 13.93 per cent in July and buying in index majors Reliance Industries and HDFC twins added to the momentum.

“The easing of inflationary pressures has encouraged domestic investors to remain optimistic about the pace of economic recovery. Better-than-expected CPI numbers, aided by slower increase in food and fuel prices, may limit the pace of rate hikes by the RBI,” said Vinod Nair, Head of Research at Geojit Financial Services.

From the Sensex pack, Mahindra & Mahindra rose the most by 2.28 per cent. Mahindra Group on Monday announced that it would launch five new electric sports utility vehicles for both domestic and international markets, with the first four expected to hit the road between 2024 and 2026.

Maruti gained 2.19 per cent, Asian Paints by 2.09 per cent, and Hindustan Unilever by 1.9 per cent. UltraTech Cement, HDFC and HDFC Bank, Tech Mahindra and Reliance Industries were among the lead gainers.

On the other hand, State Bank of India fell the most by 0.9 per cent. Bharti Airtel, Bajaj Finance, Tata Consultancy Services and NTPC were the laggards.

"Markets maintained their upward bias through the trading session aided by positive global cues and few domestic factors that triggered a rally in realty, automobile and banking stocks.

Moderating domestic inflation level has raised expectations that interest rate hike by the central bank may slow down going ahead. While strong FII fund infusion has certainly bolstered the sentiment of investors," said Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities.

(This story has not been edited by Business Standard staff and is auto-generated from a syndicated feed.)

Subscribe to Business Standard Premium

Exclusive Stories, Curated Newsletters, 26 years of Archives, E-paper, and more!

Insightful news, sharp views, newsletters, e-paper, and more! Unlock incisive commentary only on Business Standard.

Download the Business Standard App for latest Business News and Market News .

First Published: Wed, August 17 2022. 00:24 IST

RECOMMENDED FOR YOU